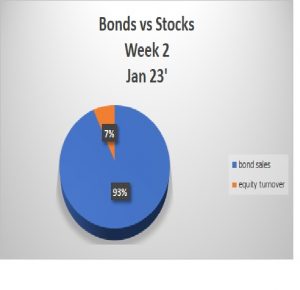

In the second week of the month of January 2023 bond trading, there were four days that recorded trades of which Wednesday’s bond trading was the best performing day of the week. Bonds of total face value of K574,009,000 were transacted in 48 trades, resulting in a market value sales of K360,291,710. Bonds are a low-risk investment issued when the government borrows money from its people. You can purchase bonds using the Lusaka Securities Exchange Application online.

Monday 9th

Bond trades of face value 106,928,000 were traded in 11 trades resulting in a market value of K58,854,840.

Tuesday 10th

Bond trades of face value 46,686,000 were traded in 3 trades resulting in a market value of K27,591,720.

Wednesday 11th

Bond trades of face value 348,095,000 were traded in 25 trades resulting in a market value of K223,061,030.

Thursday 12th

Bond trades of face value 21,004,000 were traded in 6 trades resulting in a market value of K13,278,250.

Friday 13th

Bond trades of face value 51,296,000 were traded in 3 trades resulting in a market value of K39,601,950.

Bonds of total face value of K574,009,000 were transacted in 48 trades, resulting in a market value sales of K360,291,710.