REVIEW OF PERFORMANCE FOR THE YEAR ENDED 31ST DECEMBER 2022

The financial statements have been prepared in accordance with International Financial Reporting Standards and the requirements of the Companies Act, 2017 of Zambia and the Securities Act, 2016 of Zambia.

Operating Environment

In 2022 the Corporation delivered resilient operational and financial performance even in the wake of headwinds induced in the rough market environment. The Corporation continued to implement projects to overcome these challenges which subsequently led to revenue maximization. The easing of COVID-19 pandemic restrictions and the efforts to mitigate the impact of COVID-19 pandemic by the Government, coupled with execution of robust strategies resulted in the Corporation’s continued attainment of quite strong performance in the year under review.

Financial Results Highlights

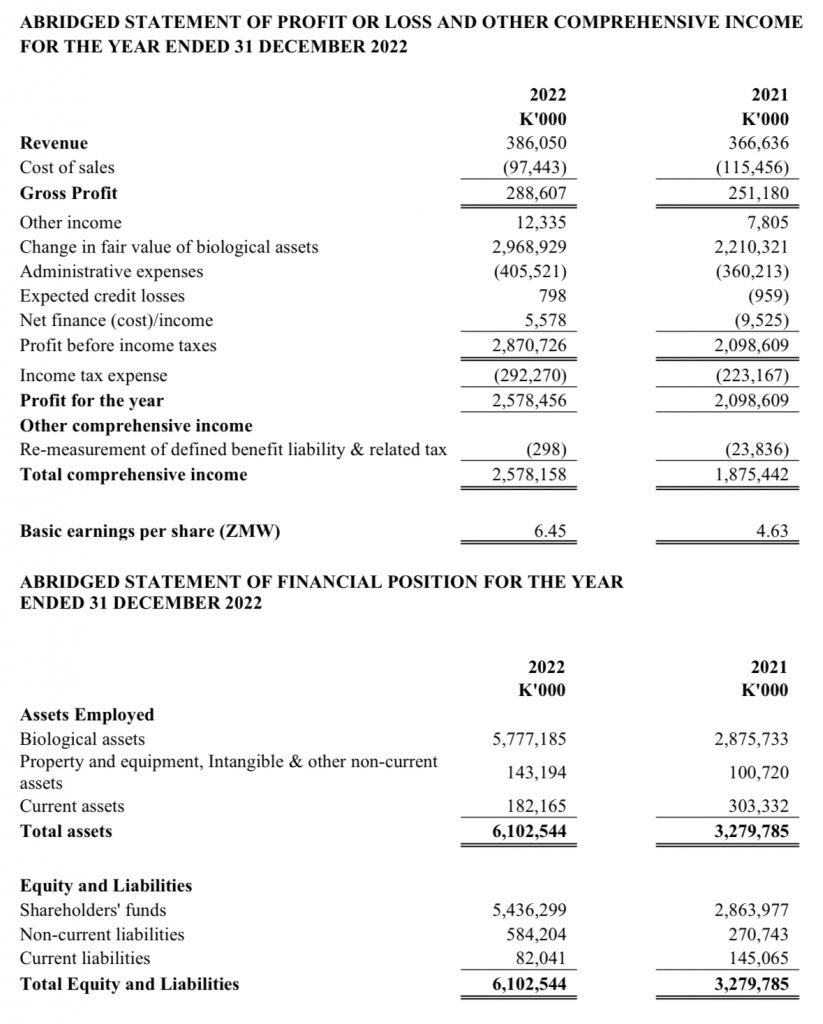

The gross profit for the year was ZMW288.6 million compared with ZMW251.1 million in the prior year representing a growth of 15%, while the gross profit margin in 2022 was 75% compared with 69% in 2021. The increase in gross profit margin was due to the improved efficiency in the production of treated poles and the lower revalued pine stumpage based on the latest forest inventory results. The net profit for 2022 was ZMW2.5 billion compared with ZMW1.8 billion in 2021, the profits in the two comparable periods were largely driven by the gain from the fair valuation of the Corporation’s biological assets.

The Corporation planted a total of 3,319 hectares of land with pine and eucalyptus in 2022, compared with 5,207 hectares of land planted in 2021 representing a reduction of 1,888 hectares, because of scaled down expansion as the Corporation mobilizes more financial resources to sustain future expansion. On 31st December 2022, Eucalyptus and Pine trees comprised approximately 54,482 hectares (2021: 50,189 hectares) which ranged from newly established plantations to plantations that were 58 years old.

The Corporation generated a total revenue of ZMW386 million from the sale of roundwood and treated poles compared with ZMW366.6 million in 2021, representing an increase of 5.3%. The positive performance was largely driven by the increase in sales of treated poles arising from the growth in the Corporation’s market share as well as a strong performance across all business and operational segments.

The operating expenditure (inclusive of expected credit losses) incurred in the year under review was ZMW405.5 million compared with ZMW361.2 million in 2021, representing an increase of 12.3 %. The increase in costs was largely due to adverse microeconomic conditions such as volatility in the price adjustments of fuel.

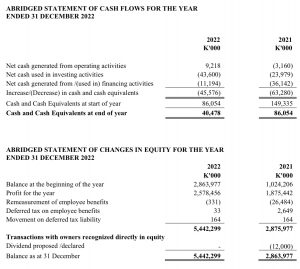

Total assets increased to ZMW 6.1 billion as of 31st December 2022 compared with ZMW3.2 billion in 2021 representing an increase of ZMW2.9 billion. The increase in assets was mainly attributed to the revaluation of the biological assets as well as investments in plant and equipment.

The increase in shareholders’ funds to ZMW5.4 billion as of 31st December 2022 from ZMW2.8 billion in 2021 was mainly attributed to revaluation of the biological assets and increase in profitability.

The liquidity position in 2022 remained strong closing with a positive working capital of ZMW106.1 million (2021: ZMW158.3 million) implying that the current assets were more than adequate to cover the Corporation’s short-term obligations.

Outlook

The Corporation continued to achieve consistent positive results in the past three years of implementation of the Corporation’s Strategic Plan 2020-2024, and the Board will review and realign the Corporation’s strategies to the new trends that have emerged to deliver better outcomes for the business. To adapt to the evolving market trends, maximize revenue and enhance business value, the Corporation will implement strategies that continue to uphold its values, purpose, and pursue projects that will lead to sustainable growth of the business. The Corporation will therefore ensure that it channels its effort to the achievement of business growth, mechanization for improved efficiencies and value addition for business sustainability.