There are interesting discussions brewing on what is known as ZED Twitter on social media around the recent statements by the central bank regarding the 2022 financial performance of banks in Zambia.

According to an article published by Money FM Zambia following a recent statement by Deputy Bank of Zambia Governor Dr. Francis Chipimo, the Central bank “disclosed that commercial banks posted significant rise in profits between 2021 and 2022. Bank Deputy Governor- Operations, Dr. Francis Chipimo revealed that over 50 percent of the profit was as a result of massive investment in government securities”.

According to Money FM, “Dr. Chipimo recently explained that part of the big investment in government securities came during the Covid-19 period when risks were heightened and banks were pulling back from lending”.

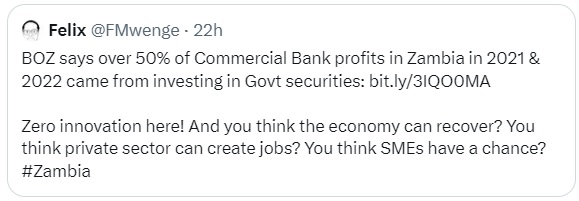

The statement from the Central Bank has sparked a twitter storm that is now pointing in the direction of how banks have created value during and after the covid pandemic. The twit that started it all was posted by “Felix @FMwenge” who said “BOZ says over 50% of Commercial Bank profits in Zambia in 2021 & 2022 came from investing in Govt securities: https://bit.ly/3IQO0MA Zero innovation here! And you think the economy can recover? You think private sector can create jobs? You think SMEs have a chance? #Zambia”

This was followed by a response from renowned author of “Laggards of the Economic Development Project”, Dr. E.D Wala Chabala, who responded “It’s called the crowding out effect of boma on the markets. And with limited resources being generated by GRZ to fund its obligations, we should expect more of this. Add to it increasing the reserve ratio, and there’s very little funding left for businesses It’s a vicious circle”.

This sparked interesting opinions such as @Mafipe who posted “@FMwenge until some kind of law or regulation comes into force restricting domestic borrowing, or a bank’s portfolio invested in securities, this won’t change. Perhaps the solution is to introduce a lower tax rate for banks with higher proportions of SME lending”.

However, some believe that our banks may never innovate and continue to give high interest rates such as @SiphoPhiri who posted and tagged the Minister of Finance Situmbeko Musokotwane and the Central Bank in his tweet “The Banks will never provide innovative products and lend to Zambians unless they are required to do so. They give pathetic interest rates to depositors and make HUGE spreads by investing it in T-bills. This, too, must stop. @BankofZambia @S_Musokotwane”.

With three banks reporting prudential results in February that showed that they had made profit after tax of over 1 billion kwacha, it is no surprise that the spotlight is now focused on them and how they create value.

The CEO of one of the top 5 performing banks in Zambia shared their thoughts of the trending topic with Founder of Financial Insight and they said that “Yes, it is an important topic. As banks, we have one chance to make a difference. As (bank name withheld), we have started out bit. It will take time to show velocity on (the) balance sheet. But you will see improvement in lending to households and SME for (our bank).”