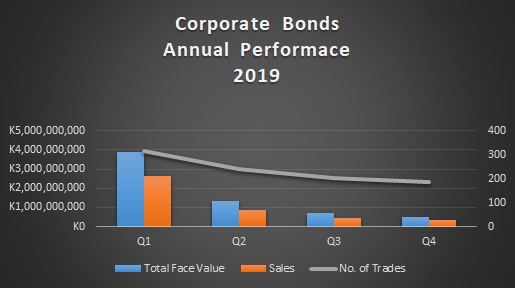

The first quarter of 2019 was the best performing quarter for Corporates raising finance trading of corporate bonds.

Corporate bonds which are forms of transferable debt securities issued by companies – are one of a range of means, alongside equity share capital, bank lending, and other methods, by which companies fund their business needs and their expansion.

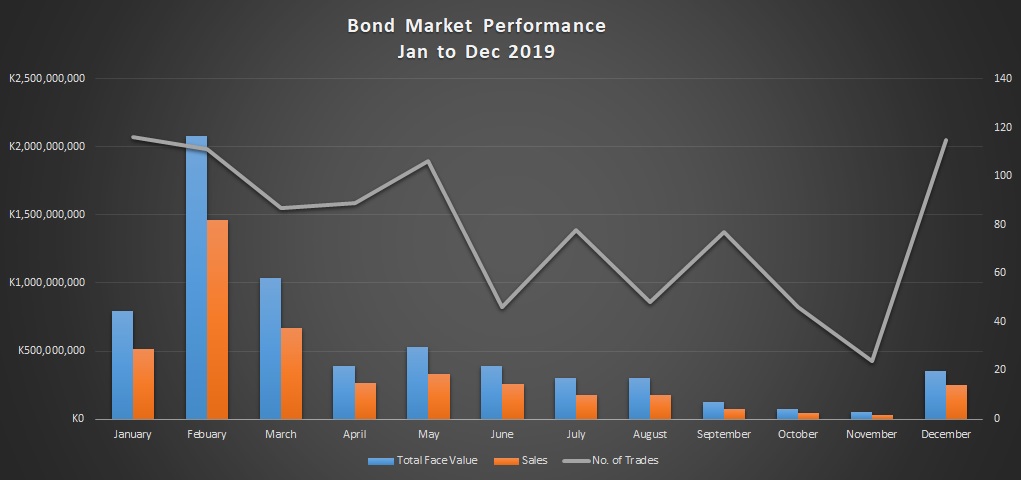

With inflation, which is one of the economic variables that affects the performance of bonds, accelerating from single to double digits during the year, bond performance deteriorated over the 4 quarters. The first quarter recorded 314, second quarter 241, third quarter 203 and finally fourth quarter had 185 trades showing the downward trajectory in performance.

Corporate bonds have long been a particularly stable and reliable source of term finance for nonfinancial-services companies in the ‘real economy’. However, in 2019, not a single corporate issued a new bond during the year. A review of many of the listed companies on LuSE’s annual reports indicated that many firms were seeking out high-cost short term financing when found in need of capital.

However, the importance of corporate bonds for issuing companies has grown, particularly as bank lending has been squeezed, and is likely to provide an alternative for many companies seeking finance in Zambia. Bonds are a pivotal mechanism for creating and sustaining enterprise, business investment, and economic growth.

Corporate bonds offer a range of advantages to investors, in particular for individuals and funds that need stable and predictable income and retention of capital value, for example, to save for retirement. They are an important means to stimulate private investment and limit citizens’ dependence on the public sector.