When the Central Bank of Zambia announced that it would be changing the mechanism for its bond issuance, sceptics and “analysts” sprung in action to provide various derivatives of what they believed would transpire under the new regime.

According to the Central Bank, in its 6th December 2023 announcement, it informed “the general public and investors in Government securities that effective from January 2024, the Government of the Republic of Zambia bonds (GRZ bonds) will be issued at par in the primary market for all new issuances”.

This meant that Government bonds would be sold at their face value, that is, the cash amount to be invested will be the same as the face value amount obliterating what many novice investors had been accustomed to which was the “substantial gain at the end”.

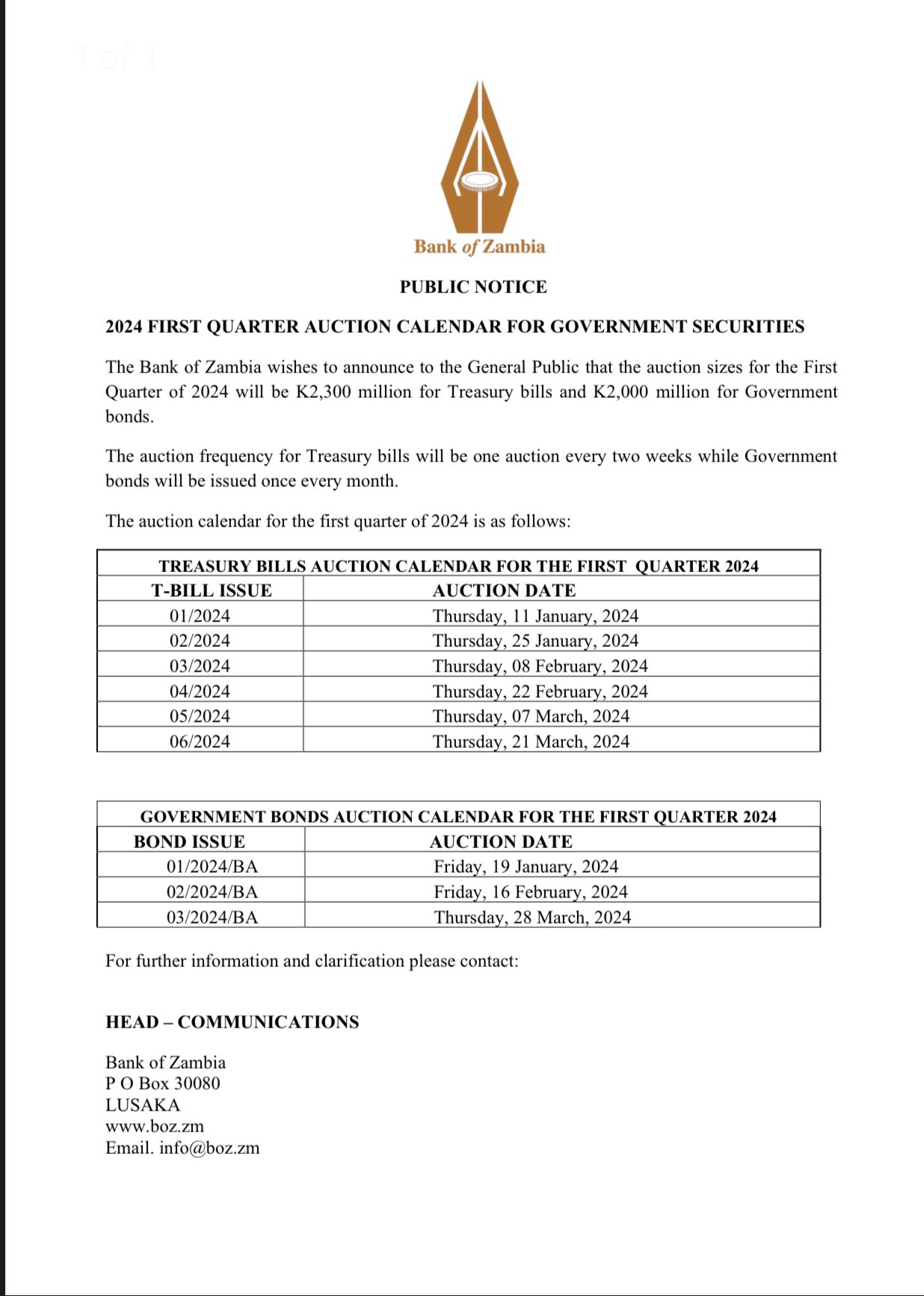

Without going into the mechanics of how the new mechanism works, as much has already been published, one has to delve into the reasons why the change was made by the Central Bank and what the probable expectation was when its first auction debuts on Friday, 19 January 2024.

“The change (bond issuance methodology) has been made to streamline Government debt metrics and debt service in general,” read the 6th December 2023 Central bank Statement.

For several years, the Central Bank has lamented high interest rates and its desire to see them lowered. It understood that one way to achieve this is through reforms. However, in this Central Bank’s case it has not been implementing all reforms all at once and understandably so. But with Zambia under a “hawk-eye” IMF programme, it is inevitable.

“The authorities have maintained their efforts to stabilize the economy despite recurrent external shocks,” read the statement from IMF’s Ms. Antoinette Sayeh, Deputy Managing Director, following the IMF Executive Board completing its second review under the Extended Credit Facility (ECF) for Zambia and subsequent approval of the US$187 Million disbursement to the country.“Continuing to take measures to restore fiscal and debt sustainability, including advancing with the debt restructuring, and implementing reforms are critical to safeguard macroeconomic stability and foster durable and inclusive growth.”

With Par value bonds offering a guaranteed return at maturity, while discount bonds offering higher yields it came down to which methodology offers lesser interest rate risk. Par bonds without a doubt compensate investors for interest rate movements whilst the higher yielding discount bonds come with higher interest rate risk.

According to the Bank of Zambia who hosted an online “X” Space on 27th December 2023 to explain how the mechanism would work, the speaker indicated that power was now in the hands of the investor as they would go head-to-head with the issuer of the bond and set interest rates that were commensurate with their desired return on investment, all parameters considered.

We are therefore about to enter an era where bond auction after bond auction, depending on macro conditions (domestic and international), coupon rates will potentially vary albeit in line with negotiating parties risk appetite.

In the end, the time value of money, in light of run-away macros will no doubt be a primary factor for any investors seeking government paper in the near term.