Story of the Day

In the final week of December 2021, yet another week of no trades on the bond market. Thus far throughout the month three consecutive weeks have not recorded trades on the bond market. The equities market completely dominated the bond market recording a 100%. Read more

Local Business and Finance Sponsored By Liquid Intelligent Technologies

Gemstone miner Kagem Mining has reinforced the Zambian government’s optimistic outlook for the future of Zambia’s gemstone and wider mining sector. Read more: Mining Weekly

MTN Zambia has launched its pilot 5G cellular network, the first of its kind in Zambia that is expected to improve speed and customer experience. Speaking at the launch on Tuesday, Technology and Science Minister Felix Mutati said government is on course to create a digital space in all sectors of the economy. Read more: ZNBC

ActionAid Zambia country director Nalucha Ziba has called on government to give a clear position on whether or not there are plans to sell Mopani Copper Mines and Konkola Copper Mines. In a statement, Monday, Ziba said government should also address questions surrounding the KCM liquidation process. Read more: News Diggers

Tourism Minister Rodney Sikumba says government has set an agenda to improve infrastructure in the country, to support the tourism and hospitality sector. Mr. Sikumba says it is the Ministry’s aim to deliver quality and adequate support infrastructure in all tourism development areas. Read more: ZNBC

International Business and Finance

The global economy faces a “grim outlook”, World Bank president David Malpass has warned, as the aftershocks of the pandemic continue to weigh on growth – especially in poor countries. His organisation’s latest forecast predicts global growth will slow to 4.1% this year from 5.5% in 2021. It attributed the slowdown to virus threats, government aid unwinding and an initial rebound in demand fading. Read more: BBC News

More than half of the world’s low-income countries, most of which are in Africa, are either currently grappling with debt distress or at risk of doing so. This is according to a blog post that was recently published on the World Bank’s website. In addition to this, there is another worrisome trend characterised by lack of debt transparency. According to the World Bank, it has become almost impossible to keep track of public debt in most low-income countries. Read more: Business Insider

Goldman Sachs cut its 2022 forecast for China economic growth Tuesday in expectation of increased restrictions on business activity aimed at containing the omicron Covid variant. “we are revising down our 2022 growth forecast to 4.3%, from 4.8% previously,” Read more: CNBC

The US Chamber of Commerce is calling for doubling the number of legal immigrants into America as a way to ease inflation and the worker shortage. Read more: CNN

Capital Markets Report Sponsored By ZCCM-IH

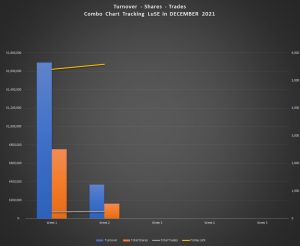

In 145 trades recorded yesterday, 633,538 shares were transacted resulting in a turnover of K1,213,444.97. A share price increase of K0.63 was recorded in Zambia Sugar. Trading activity was recorded in CEC Africa, CEC Zambia, Lafarge, Standard Chartered Bank Limited, Zambia Sugar and Zanaco. The LuSE All Share Index (LASI) closed at 6,258.36 points, -0.11% down from its previous close of 6,264.98 points. The market closed on a capitalization of K68,078,667,787 including Shoprite Holdings and K33,295,982,347 excluding Shoprite Holdings.

Chart of the Day