Good morning. Here’s what you need to know to start your day.

-

President Hichilema Secures US$8.3 Billion in FDI Pledges, Signals Economic Success for Zambia

-

IMF approves $3bn loan to Ghana

-

In the third week of May, bonds of total face value of K2,101,758,000 were transacted in 54 trades

Story of the Day

Honorable minister, Dr. Situmbeko Musokotwane during the symposium held on the update of the 1st quarter budget and economic performance, at Mulungushi conference center, said that the ministry of finance and national planning holds these regular quarterly symposium to provide updates on Zambia’s budget and overall economic performance. He said that the aim is to ensure that information about Zambia’s economic outlook is available. He started by sharing the recent economic development based on the issue of estimate. On economic growth, during his address in January this year, the projection for real GDP growth in 2022 was 3.1%, the out turn however based on further preliminary estimates from the Zambia statistic agency is a much higher growth at 4.7%, this growth was driven by the ICT, transport and the education sectors, growth was however subdued in the key sectors such as agriculture, mining, tourism and manufacturing industry. Read more

In Local Business News Sponsored by

President Hakainde Hichilema announced today at a press briefing held at State House that the Zambian government has successfully secured Foreign Direct Investment (FDI) pledges amounting to a staggering US$8.3 billion in the first quarter of this year. This remarkable achievement surpasses the FDI recorded in both 2021 and 2022, which stood at US$3.2 billion and US$6.9 billion, respectively. President Hichilema attributed this significant increase in FDI pledges to the successful implementation of the government’s policy on economic diplomacy. He emphasized the importance of Zambians understanding the purpose of his and his Cabinet members’ travels, as these visits play a crucial role in attracting investments and strengthening the country’s economic prospects. Read more: Lusaka Times

President Hakainde Hichilema has said it was now time for the G20 common framework to decide on Zambia for debt treatment as he is confident that the country has met all the required benchmarks, without exception. The Head of State also said the time had come for the creditors committee to decide on Zambia, without deferring their meetings. His sentiments resonate with those of his Finance and National Planning Minister, Situmbeko Musokotwane, who recently insisted that Zambia had met all the requirements needed by the creditors to sign the Memorandum of Understanding needed for the country to access the US$188 million distribution from the International Monetary Fund (IMF). Read more: Zambia Monitor

Zambia Association of Manufacturers has proposed that government considers reducing the Company Income Tax from 30 percent to 15 percent in the 2024 budget to promote a resilient manufacturing sector. ZAM President Ashu Sagar says the sector is also proposing that the 2024 Budget should reduce the standard VAT from 16 percent to 14 percent. Mr. Sagar said this when he made a presentation during the pre-budget meeting for the manufacturing sector in Lusaka. Read more: ZNBC

Zambia National Farmers’ Union (ZNFU) has called on government to immediately allow regulated exports of soyabeans. ZNFU President Jervis Zimba said this follows the decision by Food Reserve Agency (FRA) not to buy the crop as part of its strategic reserves during the 2023 marketing season. Mr. Zimba said the Union is disappointed that FRA will not be buying soyabeans when farmers in far flung areas have embraced crop diversification and the season promises a record crop of the commodity. He stated that the Union would want to see a situation where all the soyabeans value chain players are sustained in business and not short-changing the farmer. Read more: Money FM

Bank of Zambia Exchange Rates

| Currency | Buying | Selling |

|---|---|---|

| USD | 18.6334 | 18.6814 |

| GBP | 23.1465 | 23.2097 |

| EUR | 20.0980 | 20.1572 |

| ZAR | 0.9607 | 0.9634 |

In International Business News

The International Monetary Fund (IMF) on Wednesday approved a $3 billion loan for Ghana, a West African country in the midst of a severe economic crisis, with the first immediate disbursement of about $600 million. The programme, endorsed by the IMF board, is spread over 36 months under the Extended Fund Facility. It aims at “restoring macroeconomic stability and debt sustainability, as well as implementing wide-ranging reforms to build resilience and lay the foundation for stronger and more inclusive growth,” commented Fund Managing Director Kristalina Georgieva, quoted in an IMF statement. Read more: Africa News

China says it has become the world’s biggest exporter of cars after overtaking Japan in the first three months of the year. Officials figures released in the last week China exported 1.07 million vehicles in the period, up 58% compared to the first quarter of 2022. At the same time Japan’s vehicle exports stood at 954,185, after edging up 6% from a year earlier. China’s exports were boosted by demand for electric cars and sales to Russia. Last year, China overtook Germany to become the world’s second largest car exporter. According to China’s General Administration of Customs, China exported 3.2 million vehicles in 2022, compared to Germany’s 2.6 million vehicle exports. The shift away from fossil fuels has helped fuel the rise of China’s motor industry. Read more: BBC News

Leaders of the Group of Seven have committed to a set of further measures to pressure Russia, as its invasion of Ukraine continues for a second year. “We are imposing further sanctions and measures to increase the costs to Russia and those who are supporting its war effort,” the group said. G-7 leaders are in Hiroshima, Japan, for a three-day meeting to discuss international trade and security, as Russia continues its war in Ukraine, while the U.S. and China battle for influence in a multipolar world. “We will starve Russia of G-7 technology, industrial equipment and services that support its war machine,” the group said in a statement released late Friday, which also revealed its economic support for Ukraine’s recovery following the war. The newly announced sanctions build on previous measures and will be broadened to “ensure that exports of all items critical to Russia’s aggression including those used by Russia on the battlefield are restricted across all our jurisdictions, including exports of industrial machinery, tools, and other technology that Russia uses to rebuild its war machine,” the G-7 said in its statement. Read more: CNBC

According to the International Monetary Fund, removing trade restrictions between African nations will assist 50 million people escape poverty. The IMF made this statement via a recent study titled “Trade Integration in Africa: Unleashing the Continent’s Potential in a Changing World.” The elimination of trade barriers, according to the IMF, would boost the average amount of products traded between African nations by 53%. The research also points out that trade will rise by 15% for the remainder of the world. Read more: Business Insider

In the third week of May 2023 bond trading, there were four days that recorded trades of which Friday’s bond trading was the best performing day of the week. Bonds of total face value of K2,101,758,000 were transacted in 54 trades, resulting in a market value of K1,531,571,260. Bonds are a low-risk investment issued when the government borrows money from its people. You can purchase bonds using the Lusaka Securities Exchange Application online. Read more

In 84 trades recorded yesterday, 117,091 shares were transacted resulting in a turnover of K272,628.96. A share price increase of K0.01 was recorded in Standard Chartered Bank Limited. Trading activity was recorded in CEC Zambia, Pamodzi, Zambeef and Zanaco. The LuSE All Share Index (LASI) closed at 8,154.62 points, 0.05% higher than its close previous at 8,150.79 points. The market closed on a capitalization of K76,427,268,778.90 including Shoprite Holdings and K41,644,583,338.90 excluding Shoprite Holdings.

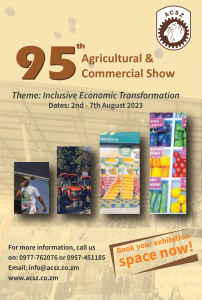

Picture of the Day