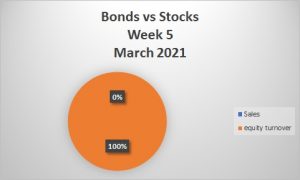

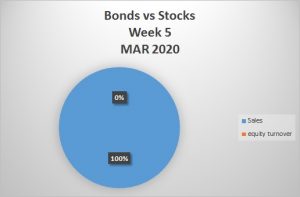

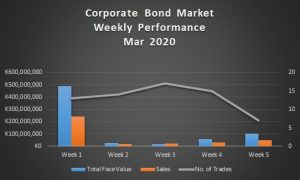

This week was a combination week of April and March. There was very minimal trading during the week only one day recorded trades of which fell into the month of April Leaving the final week of March with no trades. This means for the fifth week of March the equities market eclipsed the bond market recording 100%.In comparison of week 5 of 2020 where we see the complete opposite of the bond market completely eclipsing the equities market recording 100% to 0%.

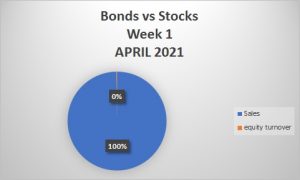

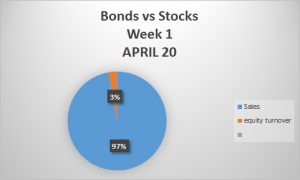

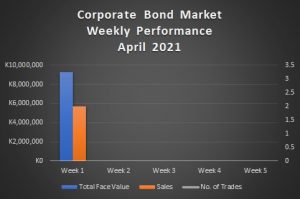

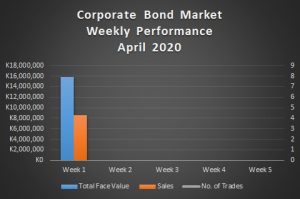

In April, the bond market completely dominated the equities market recording a 100% to 0%. As we compare week one of 2020 which recorded a 97% on the bond market to 3% on the equities side.

Equity Market

In the week ended 2nd April 2021, a total of 25,165 shares were transacted in 16 trades, yielding a market turnover of K276,051. Trading activity was recorded in CEC ZAMBIA, ZAMBIA CONSOLIDATED COPPER MINES, PUMA and ZANACO. The LuSE All Share Index (LASI) maintained its close at 4,021.07 points, as there were no share price movements. The market closed on a capitalization of K57,838,837,980 including Shoprite Holdings and K23,594,197,206 excluding Shoprite Holdings.

Bond Market

Bonds of total face value of K9,250,000 were transacted in 3 trades, resulting in a market value sales of K5,668,400.

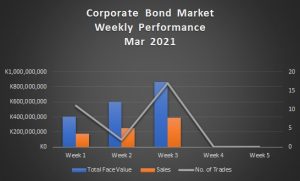

Week three of march was the best performing week of the month.

Important announcements

COPPERBELT ENERGY CORPORATION PLC (“CEC”)

In accordance with Section 3.4(b) of the Lusaka Securities Exchange (“LuSE”) Listings

Requirements, the Board of Directors of the Copperbelt Energy Corporation Plc (“CEC” or

“the Company”) hereby advises the Shareholders of CEC that the Earnings Per Share (“EPS”)

for the twelve months ended 31st December 2020 is expected to be approximately 54% lower

than that for the twelve months ended 31st December 2019