Story of the Day:

Following its initial public offering in 2019, ZAFFICO announced an approximately 34.4% reduction in earnings for the financial year 2019 from 2018, according to its first set of published financials since the IPO. Read more

Local Business and Finance Sponsored By Liquid Telecom

Bank of Zambia said on Friday it has established a 10 billion Zambian kwacha ($533.33 million) medium-term refinancing facility for financial service providers (FSP) as part of emergency policy measures aimed at easing a liquidity crunch triggered by the coronavirus. Read more: Reuters

Moody’s Investors Service cut Zambia’s credit rating to the second-lowest level, citing rising default risks and a debt restructuring that could involve significant losses for private creditors. Read more: Bloomberg

Absa bank has forecasted that the kwacha will continue to depreciate in the medium term due to the continued rally of the dollar and economic impact of coronavirus. Read more: Zambia Daily Mail

Government has suspended mining activities at the Roan Basin CNMC-Luanshya copper Mines PLC. Mines Minister Richard Musukwa says this is because the firm has not met all the conditions of approval of the project. Mr. Musukwa says it is sad that the firm had started to carry out some activities even before the project is fully approved. Read more: ZNBC

International Business and Finance Sponsored By Royal Air Charters

The virtual meeting between OPEC and its allies scheduled for Monday has been postponed, sources familiar with the matter told CNBC, amid mounting tensions between Saudi Arabia and Russia. The meeting will now “likely” be held on Thursday, sources said. Read more: CNBC

The coronavirus pandemic has created an economic crisis “like no other” — one that is “way worse” than the 2008 global financial crisis, the International Monetary Fund’s top official said Friday. “Never in the history of the IMF have we witnessed the world economy come to a standstill,” Kristalina Georgieva, managing director of the IMF, said at a news conference. Read more: CNBC

Ratings agency Fitch downgraded South Africa’s credit rating further into “junk” territory on Friday, another blow for Africa’s most industrialised economy, which is still smarting from a Moody’s downgrade last week. Fitch lowered its long-term foreign-currency issuer default rating to ‘BB’ from ‘BB+” and assigned a negative outlook. Read more: Africa News

Rwanda has secured a $109.4 million in emergency coronavirus funding from the International Monetary Fund, the first African country to do so, the fund said late on Thursday. Read more: Reuters

The coronavirus pandemic and lockdowns imposed by governments on both sides of the Atlantic have pushed the global economy into the sharpest downturn since the Great Depression, data released on Friday signalled. Read more: Financial Times

The cost of the coronavirus pandemic could be as high as $4.1 trillion, or almost 5% of global gross domestic product, depending on the disease’s spread through Europe, the U.S. and other major economies, the Asian Development Bank said. Read more: MSN

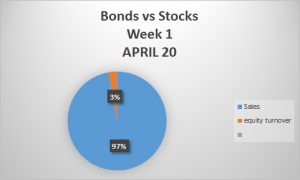

Capital Markets Report

In 2 trades recorded Friday, 33 shares were transacted yielding a market turnover of K40. Trading activity was recorded in Copperbelt Energy Corporation. The LuSE All Share Index (LASI) maintained its close of 4,233.69 points, as there were no share price movements. The market closed on a capitalization of K57,246,647,914 including Shoprite Holdings and K23,007,441,934 excluding Shoprite Holdings.

Chart of the Day: