Story of the Day:

No one could have predicted that 2020 would see the emergence of a global pandemic. The novel corona virus later named COVID-19 at first looked just like China’s problem. But little did the world know that it was just a matter of time before it becomes a global problem. COVID -19 has changed the total round of our daily activities from the way we: eat, exercise, do business, teach and learn, relate with each other, travel and even worship. Read more

Local Business and Finance Sponsored By Liquid Telecom

Zambia’s Purchasing Managers Index (PMI) slid deeper into contraction to 44.7 from 48.5 in February as input inflation was at a record high given currency depreciation effects, energy risks and lack of liquidity in the market. The copper producer was last in positive territory in February 2019 when it headlined 50.4. Read more: The Business Telegraph

The Bank of Zambia has warned of unprecedented economic and public health shocks resulting from the COVID-19 outbreak, although the disease’s full impact cannot be quantified at the moment. Read more: News Diggers

The Ministry of Finance has announced that it released total of K5.64 billion in March 2020, with K1.07 billion going towards domestic and external debt servicing. And the ministry further announced that K104.7 million was also released in the same month for the purchase of drugs in Public Health Institutions and the fight against the COVID-19. Read more: News Diggers

Zambia says the market anticipates some resilience from the kwacha as a result of the measures announced by Bank of Zambia last week. FNB Zambia stated that although the BoZ didn’t, however, underline specifics on the measures it would take to address the volatility in the currency market, some resilience from the kwacha is expected. Read more: Zambia Reports

Indeni Petroleum Refinery is this month expected to resume operations. Energy Minister Matthew Nkhuwa disclosed that the plant will be tested mid this month before it resumes operations. Mr. Nkhuwa says once operational, government will get a new consignment of crude oil feedstock which will determine the price of fuel, taking into consideration the exchange rate of the kwacha against the dollar. Read more: ZNBC

Former Finance Minister Felix Mutati says only a HIPC-style debt relief from international development partners can help poor nations hit by the deadly coronavirus such as Zambia to recover from its devastating economic effects. Read more: Zambian Observer

The Policy Monitoring and Research Centre (PMRC) has urged Government to consider extending carbon tax to other sectors so that revenue can be channelled to the promotion of climate-smart agricultural practices. Read more: Zambia Daily Mail

International Business and Finance Sponsored By Royal Air Charters

More than 100 global organisations are calling for debt payments of developing countries to be dropped this year. Major charities including Oxfam and ActionAid International are asking for the debt relief which would free up more than $25bn (£20bn) this year. They have written to world leaders along with major central banks calling for a range of debt relief measures. Read more: BBC News

Japan is committing nearly $1 trillion to try to protect its economy from the fallout from the coronavirus pandemic. Japanese Prime Minister Shinzo Abe on Monday announced a 108 trillion yen ($989 billion) relief package — a staggering amount equivalent to about 20% of the annual output of the world’s third biggest economy. Read more: CNN

South Korean tech giant Samsung said Tuesday its operating profit for the three months that ended in March likely rose from a year ago and beat expectations slightly. Samsung said it expects 6.4 trillion Korean won ($5.23 billion) in first-quarter operating profit for 2020, up 2.7% from the 6.23 trillion won it posted for the same period a year earlier. Read more: CNBC

South Africa’s central bank slashed its growth forecasts on Monday, predicting the economy could shrink by as much as 4% in 2020 due to the novel coronavirus, which has forced a national lockdown and triggered two credit ratings downgrades. Read more: Reuters

The Congolese central bank expects the economy to grow 4.6% in 2019, after revising down an earlier estimate of 5.1% during a policy meeting on Friday. Read more: Reuters

Capital Markets Report

In 19 trades recorded yesterday, 17,028 shares were transacted yielding a market turnover of K5,929. A share price loss of K0.01 was recorded in Copperbelt Energy Corporation and a share price loss of K0.02 was recorded in PUMA. Trading activity was also recorded in Bata, Standard Chartered Bank Limited, Zanaco and CEC Africa on the quoted tier. The LuSE All Share Index (LASI) closed at 4,227.66 points, -0.14% down from its previous close of 4,233.69 points. The market closed on a capitalization of K57,220,397,908 including Shoprite Holdings and K22,981,191,928 excluding Shoprite Holdings.

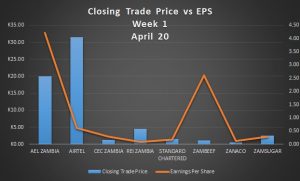

Chart of the Day: