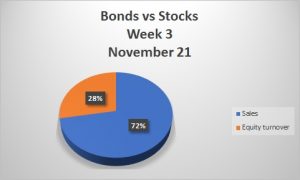

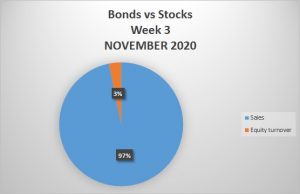

Three weeks into the month of November on the Lusaka Stock Exchange we see the equities market record a score of 28% to 72% on the bond market. In the last few weeks we see the bond market start to pick up and record trades, although it might not be a full week of trades there is gradual progress.

Shoprite Holdings Plc recorded the highest Market Capitalization throughout the week.

In comparison to week three of November 2020, this year as made progress as the equities market only recorded a 3% to 97% on the bond market.

Equity Market

In the week ended 19th November 2021, a total of 655,048 shares were transacted in 465 trades, yielding a market turnover of K1,634,284. Trading activity was recorded in AFRICA EXPLOSIVES CORPORATION LIMITED, AIRTEL, BRITISH AMERICAN TOBACCO ZAMBIA, COPPERBELT ENERGY CORPORATION, INVESTRUST, LAFARGE, PAMDOZI, ZAMBIA REINSURANCE, PUMA, STANDARD CHARTERED ZAMBIA, SHOPRITE HOLDINGS, ZAMBEEF, ZAMBIAN BREWERIES, ZAMBIA METAL FABRICATORS, ZANACO, ZAMBIA CONSOLIDATED COPPER MINES, ZAMBIA SUGAR and FIRST QUANTUM MINING. The LuSE All Share Index (LASI) closed at 5,440.89 points. The market closed on a capitalization of K65,079,635,922 including Shoprite Holdings and K30,296,950,482 excluding Shoprite Holdings.

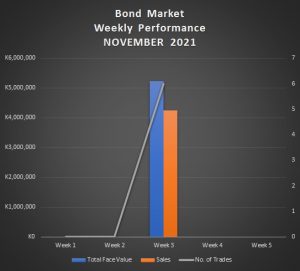

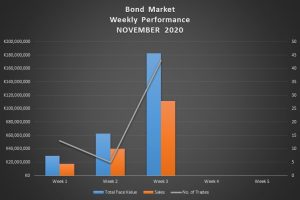

Bond Market

Bonds of total face value of K5,235,000 were transacted in 6 trades, resulting in a market value sales of K4,252,150.

The third week of November has been the only week to record trades on the bond market thus far.

Important announcements

LAFARGE ZAMBIA PLC

Financière Lafarge, Pan African and Huaxin have advised the Company that Hauxin has purchased 150,026,436 Lafarge shares representing a 75.00% shareholding via trades conducted on the Lusaka Securities Exchange (“LuSE”) at a price of ZMW 13.16 per share on 30 November 2021. This purchase consideration is subject to a post-completion price adjustment exercise that has commenced and is expected to be completed within 8 weeks.