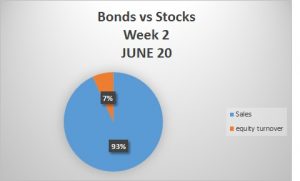

In the second week of June 2020 bond trading on LuSE. The equities market records a one percentage less than it did last week. Recording a score of 7% to 93% on the bond market as compared to last week with a 8% to 92%. The bond market continues to dominate the equities market.

Equity Market Update

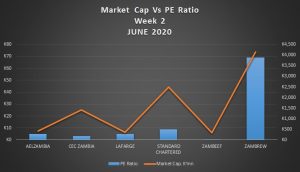

In the week ended 12th June 2020, a total of 788,848 shares were transacted in 62 trades, yielding a market turnover of K5,917,320. Trading activity was recorded in AFRICA EXPLOSIVES LIMITED ZAMBIA, CEC ZAMBIA, LAFARGE, STANDARD CHARTERED ZAMBIA, ZAMBEEF, ZAMBIA BREWERIES and ZAMBIA SUGAR. The Index (LASI) closed at 3,971.11 points. The market closed on a capitalization of K56,105,319,918 including Shoprite Holdings and K21,866,113,938 excluding Shoprite Holdings.

Bond Market Update

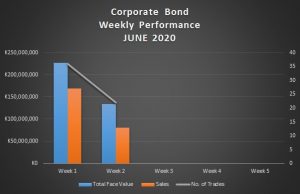

During the week, bonds of total face value of K134,425,000 were transacted in 22 trades, yielding a market value sales of K80,388,000.

Important announcements

COPPERBELT ENERGY COPORATION PLC

In accordance with Section 3.4(b) of the Lusaka Securities Exchange Listings Requirements (“LuSE Listings Requirements”), the Board of Directors (“the Board”) of Copperbelt Energy Corporation Plc (“CEC” or “the Company”) wishes to inform shareholders and the market that it has approved the sale of the CEC Africa loan (“the Loan”) to BP Investment Limited (“BPI”) of Nigeria.

COPPERBELT ENERGY COPORATION PLC

In accordance with Section 11.40 of the Lusaka Securities Exchange Listings Requirements (“LuSE Listings Requirements”), the Board of Directors of Copperbelt Energy Corporation Plc (“CEC” or “the Company”) wishes to inform shareholders and the market that the Power Supply Agreement (“PSA”) between CEC and Konkola Copper Mines Plc (“KCM”) came to an end on 31 March 2020 but was extended, through mutual agreement of the parties, to 31 May 2020. Consequently, effective 1 June 2020, there is no contractual basis upon which CEC can continue to supply electricity to KCM

In accordance with the Lusaka Securities Exchange (“LuSE”) Listings Requirements, the Board of Directors of Zambeef Products Plc hereby advises the shareholders of the Group that the earnings per share for the half year period ended 31 st March 2020 is expected to be 0.41 Ngwee (0.03 Cents) compared to a loss per share of 7.92 Ngwee (0.67 Cents) for the haf year ended 31 March 2019. This represents a growth of 105% in Kwacha terms (104% in US$ terms) compared to the six months period ended 31st March 2019.