Over the last year many finance teams have successfully implemented two new accounting standards, IFRS 9 – Financial instruments and IFRS 15 – Revenue from contracts with customers and are realising that the level of effort required and changes have been greater than anticipated. Drawing from this experience, finance teams will need to engage early enough to understand the key changes and wider business implications of implementing IFRS 16 – Leases which replaces IAS 17 and came into effect on 1 January 2019. IFRS 16 is expected to result in a fundamental change in the lease accounting model under IAS 17 of which lessees distinguished between on-balance sheet finance leases and off-balance sheet operating leases. Instead, IFRS 16 will result in a single on-balance sheet accounting model which is similar to the finance lease accounting under IAS 17 and will bring all leases onto the balance sheet unless certain exemptions are met. This change is expected to result in increased transparency and comparability.

Almost all companies in every sector lease rather than own some of their operating assets from financial institutions with leased branches and ATMs to retailers with leased stores and the purpose of this article is to highlight the key changes expected from the implementation of IFRS 16 and the potential impact on working capital considerations for various stakeholders.

Accounting by lessees

Under the new standard, the lessee will recognizes a right-of-use (ROU) asset at cost and a lease liability. Leases will be accounted for as if the company had borrowed funds to purchase a leased asset.

Right of use asset = Lease liability + initial direct costs + Prepaid lease payments + estimated costs to dismantle, remove or restore, measured in accordance with IAS 37 less lease incentives received.

Lease liability = Present value of lease rentals + Present value of expected payments at the end of the lease.

The discount rate used in the present value calculation above is the interest rate implicit in the lease which is the rate that causes the present value of lease payments and the unguaranteed residual value to equal the sum of the fair value of the underlying asset and any initial direct costs of the lessor. If the lessee cannot readily determine the interest rate implicit in the lease, then the lessee uses the incremental borrowing rate for a similar type of arrangement.

The ROU asset will be depreciated on a straight-line basis and the lease liability is discounted using the effective interest method. Therefore, the total lease expense in profit or loss is now going to be presented as interest and depreciation expense rather than an operating expense under IAS 17.

Lessees have optional exemptions in applying the new standard to the following arrangements:

- Short term leases of which the lease term is determined as 12 months or less.

- Leases of low-value items i.e. assets with an asset value of USD 5,000 or less even if material in aggregate.

Accounting by lessors

The International Accounting Standards Board (IASB) aimed to minimize the changes to lessor accounting and therefore much of the guidance in IFRS 16 is substantially the same as under IAS 17.

Working capital considerations

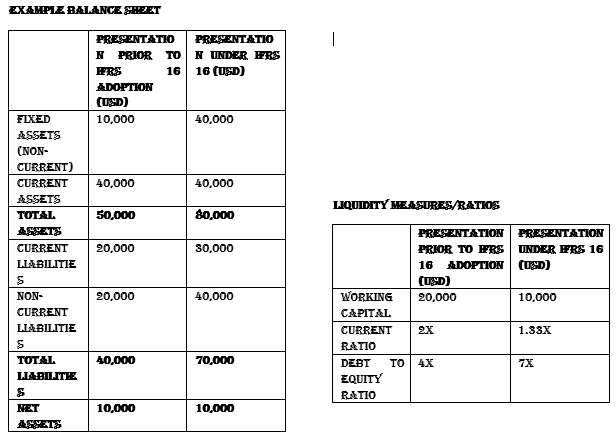

Most companies and users understand that the new standard brings more leases on-balance sheet but very few considerations have been made as to the expected impact on working capital. Below is a simple example of the expected changes.

A company is currently leasing its office premises on a 3-year lease term with an annual rent of USD 10,000 and ROU asset is recognized at a cost of USD 30,000. A corresponding entry will be made to current liabilities for the amount due over the next year i.e. USD 10,000 and the remaining USD 20,000 recognized as a long term liability.

Based on the illustration above, companies should expect an adverse impact on various measures of liquidity. Users of financial statements including investors and lending institutions use liquidity measures to assess how well a company can liquidate its assets to meet its current obligations. Companies that have ordinarily had a positive working capital position could end up in a negative working capital position resulting in further assessments about the Company’s ability to meet its short-term obligations. Investors and lending institutions should consider assessing whether the on-balance sheet accounting of leases will have a significant impact on their investment and lending decision making processes and contract negotiations.

Other considerations

The potential impact on the computation of regulatory capital

Regulated financial institutions that recognize ROU assets on the balance sheet will need to assess the impact of this asset in the calculation of regulatory capital. The Basel Committee on Banking Supervision issued a press release dated 6 April 2017 for “frequently asked questions” related to lease accounting which states that the “ROU should not be deducted from regulatory capital so long as the underlying asset being leased is a tangible asset.” The press release further states that an “ROU asset should be risk-weighted at 100%, consistent with the risk weight applied historically to owned tangible assets.” Guidance should be sought from the local regulator, Bank of Zambia, if the clarity is needed on the treatment of ROU assets in the computation of regulatory capital.

Sales leaseback arrangements

Sales leaseback arrangements are complex transactions where an entity transfers an asset to another entity and then leases it back with the objective of providing off-balance-sheet financing. Under IFRS 16, the seller or lessee will recognize the sale leaseback transaction on-balance sheet unless the leaseback is short or the underlying asset is of low value. Despite this change to on-balance sheet accounting, companies can still explore this option to free up cash for working capital needs.

Things to think about now

Transition to IFRS 16 will require time and the possible impact is too far-reaching to wait until the last minute. As we approach the close of the 2019 financial year, finance teams should evaluate the impact that this new standard will have beyond just financial reporting. Planned lease arrangements should be carefully reviewed and negotiated to ensure that the potential impacts of the new standard on wider business practices are minimized.

| Rabecca Hichilo is an Associate Director with KPMG Zambia. The views expressed in this article are her own and not necessarily those of KPMG. |