Story of the Day

Towards the end of Q4 2021, Zambia’s investment house announced the appointment of seasoned Banker and Investment Professional Dolika Banda as its new Board Chairperson, according to statement from ZCCM IH. In a statement issued by the Head of Corporate Affairs Loisa Mbatha on 15th December 2021, ZCCM-IH’s new Board Chair is an investment and financial with a wealth of over 36 years of experience from various local and international organisations across the globe. Read more

Local Business and Finance Sponsored By Liquid Intelligent Technologies

Secretary to the Treasury Felix Nkulukusa has affirmed that the 2022 budget came into effect on 1 January, 2022. This is the first national budget under the new dawn administration. The Secretary to the Treasury added that the Ministry of Finance and National Planning will introduce “performance tracking dashboards” for each ministry and spending agency as a way of promoting adherence to implementation of budgeted programs. Read more: Zambian Observer

First National Bank (FNB) Zambia has recorded a positive response from its customers across all business segments who have accessed K533 million out of the K550 million the organisation acquired from the Bank of Zambia’s K10 billion coronavirus relief funds. Read more: Zambia Daily Mail

Zambia Information and Communications Technology Authority (ZICTA) has exceeded its annual revenue collection by 125 percent to over K826.7 million as at November 30 against a target of about K372.5 million stipulated in the 2021 national budget. Ream more: Zambia Daily Mail

The Bank of Zambia has increased its government security appetite by 53% to K6.6 billion monthly according to a first quarter prospectus on its website. The Bank of Zambia will now offer K2.0 billion worth of T-bills every fortnight from the K1.4 billion while it’s monthly bond offerings has widened to K2.6 billion from K1.5 billion in 2021. Read more: The Business Telegraph

As we reflect on performance of the year 2021 in the investment faculty, Africa’s second largest red metal producer Zambia has one outstanding investment option that surpassed traditional risk free assets, village banking. The investment options annual interest yield of above 120% qualifies it for most lucrative asset even when adjusted for inflation. Read more: The Business Telegraph

International Business and Finance

African startups raised $4.65 billion in 2021, about twice the sum they raised in 2020. There was a 25% increase in the number of deals announced last year when compared to the deals reported in 2020. As expected, Africa’s fintech ecosystem was most attractive to investors, having attracted 62% of the funds. Read More: Business Insider

Start the year how you intend to spend it, right? For the Dow, that means at all-time highs. The index finished up 0.7%, or nearly 250 points, on Monday, logging a new record high on the first trading day of 2022. Similarly, the S&P 500, the broadest measure of Wall Street, closed at a record, up 0.6%. The Nasdaq Composite still has a little more to go until the all-time high it set in November. The tech-heavy index closed up 1.2%. Read more: CNN

US technology giant Apple has become the first company to hit a stock market valuation of $3tn. The firm’s share price has risen by around 5,800% since co-founder and former chief executive Steve Jobs unveiled the first iPhone in 2007. However, its value slipped a little from that milestone, to end Monday’s trading session in New York at $2.99tn. Read more: BBC News

Two of the biggest US phone firms have agreed a government request to delay the rollout of 5G services this week. The US Transportation Secretary Pete Buttigieg and the Federal Aviation Administration (FAA) made the request over concerns about aviation safety. Plane makers have warned that C-Band spectrum 5G wireless signals may interfere with sensitive aircraft electronics and could disrupt flights. AT&T and Verizon initially rejected the delay request, before reversing. BBC News

Capital Markets Report Sponsored By ZCCM-IH

In 15 trades recorded yesterday, 3,206 shares were transacted resulting in a turnover of K8,563.10. Trading activity was recorded in Copperbelt Energy Corporation and Lafarge. The LuSE All Share Index (LASI) closed at 6,059.86 points, 0.0% up from its previous close.. The market closed on a capitalization of K67,182,821,998 including Shoprite Holdings and K32,400,136,558 excluding Shoprite Holdings.

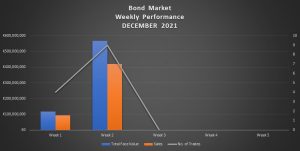

Chart of the Day