Story of the Day:

ZCCM IH recently informed the market on the outcome of the tribunal proceedings which sought to determine whether the Provisional Liquidator at KCM would continue in office or not following Vedanta Resource Limited and Vedanta Resources Holdings Limited pursuing the matter. The ruling was in favor of ZCCM IH by way of the arbitrator dismissing the application by the Vedanta Group. Read more

Local Business and Finance Sponsored By Liquid Telecom

A credit derivatives committee has been asked to rule whether a ‘failure to pay’ credit event has been triggered by Zambia, paving the way for a potential payout for holders of default insurance on the country’s sovereign debt. The EMEA Credit Derivatives Determinations Committee was asked the question after the government failed to pay a $42.5 million coupon at the expiry of the grace period on Friday, according to a post on its website on Monday. Read more: Reuters

The Zambia Forestry and Forest Industries Corporation (ZAFFICO) has finally submitted expenditure returns to the Accountant General, on revenues from the exports of Mukula logs. According to the Auditor General Report over US$5.4 million was raised from the export of Mukula logs between September 8 ,2016 and December 7, 2018. Read more: ZNBC

President Edgar Lungu says the Citizens Economic Empowerment Commission should make it easy for people in rural areas to access funds especially those who have land for projects like fish farming. President Lungu says there is no need for the Commission to demand for title deeds before a person with a small business can access empowerment funds. Read more: ZNBC

Centre for Trade Policy and Development (CTPD) says it expects the Bank of Zambia (BoZ) to maintain its Monetary Policy Rate (MPR) at 8% to continue stimulating economic growth. Read more: News Diggers

International Business and Finance

Bitcoin, the world’s best-known cryptocurrency, has jumped above $17,000 to hit a three-year high.

The digital currency has suffered plenty of wild price swings since it was launched in 2009. But investors have been flocking to cryptocurrencies during the pandemic-driven volatility on global stock markets. Read more: BBC News

Given its absence in the world’s largest trade agreement, the U.S. might want to “keep some of the doors open” with the participating Asia-Pacific countries by negotiating bilateral deals with them, an economist from HSBC said Tuesday. Read more: CNBC

Gold mine investors in Zimbabwe are pressurizing the government to change the laws that compel producers to sell their products to central banks. The investors argue that the central banks pay for their products in local currencies which have no value abroad. Read more: Business Insider

Goldman Sachs Group Inc is preparing for a second round of job cuts, three months after it began eliminating around 400 positions, people familiar with the matter told Reuters on Tuesday. Read more: Reuters

Capital Markets Report Sponsored By ZCCM-IH

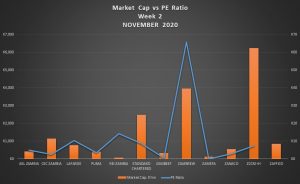

In 24 trades recorded yesterday, 1,956,815 shares were transacted yielding a market turnover of K1,359,066. A share price gain was recorded in Lafarge of K0.58. Share price losses were recorded in Copperbelt Energy Corporation of K0.03 and in Standard Chartered Zambia of K0.08. Trading activity was also recorded in PUMA and CEC Africa on the quoted tier. The LuSE All Share Index (LASI) closed at 3,868.78 points, 0.39% down from its previous close of 3,883.92 points. The market closed on a capitalization of K57,318,055,783 including Shoprite Holdings and K23,078,849,803 excluding Shoprite Holdings.

Chart of the Day: