Story of the Day:

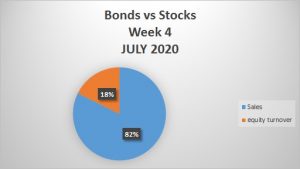

As we anticipated the fourth week of July 2020 bond trading on the LuSE would be the turn around week for the equities market as it recorded a score of 18% to 82% on the bond market. Read more

Local Business and Finance Sponsored By Liquid Telecom

The year-on-year inflation rate has for the second consecutive month in a row recorded a reduction. For the month of July 2020, inflation slightly dropped to 15.8% from 15.9% recorded in June 2020 attributing the development to price decreases in food items. Read more: Lusaka Times

The Bank of Zambia launched its new strategic plan for 2020-2023, under the theme, “Building an Inclusive and Resilient Financial Sector”. It represents the priority areas the Bank wants to concentrate on during this period with Financial Stability and Financial Inclusion as the two focus areas for the Plan. Read more: Zambian Business Times

The Zambia State Insurance Corporation – ZSIC Life has postponed its decision to get listed on the Lusaka Securities Exchange – LuSE to a date which will be confirmed by the end of this year 2020. Read more: Zambian Business Times

With liquidity north of K3.5bln, the Bank of Zambia sold a yard in cash terms absorbing part of the K1.25bln appetite observed. Of the total bids received K891.6mln was for 1-year paper which housed K867.1mln of that liquidity locking in at 25.48%, 52 basis points lower than a fortnight ago. Read more: The Business Telegraph

The Bank of Zambia (BoZ) has so far disbursed over One billion kwacha to Financial Service Providers (FSP’s) from the Targeted Medium-Term Refinancing Facility of the 10 billion kwacha stimulus package. Read more: ZNBC

The first ever gemstone processing plant in Southern Africa is expected to open in Zambia next month. Ministry of Mines and Minerals Development Permanent Secretary, Barnaby Mulenga says the US$3.2 million Mutinta Jewellery processing plant will spur the much desired value addition in the mining sector. Read more: ZNBC

Finance Minister Dr Bwalya Ng’andu says the issuance of bonds will not worsen the Zambia’s current debt position because they are long term. And Dr Ng’andu says Zambia is poised to save about K3.7 billion from the G20 debt service suspension initiative. Read more: News Diggers

International Business and Finance

The U.S. economy saw the biggest quarterly plunge in activity ever, though the plummet in the second quarter wasn’t as bad as feared. GDP from April to June plunged 32.9% on a yearly basis. Economists surveyed by Dow Jones had been looking for a drop of 34.7%. Read more: CNBC

The coronavirus crisis might be causing widespread economic upheaval around the world, but the world’s biggest tech firms are thriving. Amazon sales soared 40% in the three months ending June, while Apple saw a surge in purchases of its iPhones and other hardware. At Facebook, the number of people on its platforms, which include WhatsApp and Instagram, jumped by 15%. Read more: BBC News

Europe’s largest economy, Germany, suffered its worst slump on record in the second quarter, as the coronavirus pandemic took a heavy toll on exports and consumer spending. According to Germany’s federal statistics office, second quarter GDP declined 10.1% on the first quarter, its worst fall since records began in 1970. That’s equivalent to a drop of 11.7% on the same period last year. Read more: CNN

Mastercard Inc’s quarterly profit beat analyst estimates on Thursday, as lower costs softened the blow from fewer people using the payment processor’s cards during the coronavirus pandemic. Net income fell about 31% to $1.42 billion in the second quarter ended June 30. Excluding items, profit was $1.36 per share, beating estimates for $1.16. Read more: Reuters

Ford’s revenue fell 50% in the second quarter to $19.4bn. The company reported an adjusted $1.9bn loss before interest and taxes in the second quarter — far better than the $5bn loss CEO Tim Stone predicted three months ago. Read more: Financial Times

Capital Markets Report Sponsored By ZCCM-IH

In 11 trades recorded yesterday, 1,433 shares were transacted yielding a market turnover of K2,066. A share price loss of K0.01 was recorded in Copperbelt Energy Corporation, and a share price gain of K0.20 was recorded in Lafarge. Trading activity was also recorded in Bata, Puma and ZCCM. The LuSE All Share Index (LASI) closed at 3,865.40 points, 0.14% up from its previous close of 3,859.94 points. The market closed on a capitalization of K55,645,209,233 including Shoprite Holdings and K21,406,003,253 excluding Shoprite Holdings.

Chart of the Day: