Story of the Day:

Many companies are feeling the disruption that COVID-19 has brought to their businesses. It is clear the pandemic has had a negative impact on many businesses in Zambia as seen from the June 2020 Purchasing Managers index which shows that the productivity of local businesses is still subdued. Read more

Local Business and Finance Sponsored By Liquid Telecom

Absa has rolled out Zambia’s first contactless payment card as the COVID-19 pandemic quickens digital strategy implementation, the bank’s CEO for Zambia Mizinga Melu tells The Africa Report. Read more: The Africa Report

Zambia’s leading cement and aggregate manufacturer and LarfargeHolchin local unit, Larfarge Zambia recorded an impressive sales revenue of K142 billion (about US$95 million) for the year 2018, up by 13% compared to 2017. Read more: Zambian Business Times

Mazabuka based Zambia Sugar, a LuSE listed subsidiary of Illovo of South Africa has advised that the company that the Earnings per Share – EPS for the half year ended 28 February 2019 is expected to be approximately 68% higher than that for the half year ended 28 February 2018. Read more: Zambian Business Times

Zambia on Tuesday launched an emergency COVID-19 social cash transfer scheme to help vulnerable communities affected by the pandemic. Read more: CGTN

Chief Government Spokesperson Dora Siliya says Government has intensified efforts, in collaboration with other partners, to provide investment opportunities for young people. Read more: The Independent Observer

Commerce Trade and Industry Minister Christopher Yaluma says the pull out of Spar Chain Store has impacted negatively on local employees. Speaking at a media briefing, Mr. Yaluma regretted that the advent of the Coronavirus has impacted negatively on both international and local investment in Zambia. Read more: ZNBC

International Business and Finance

South Africa’s economy is likely to contract by 7.2% this year due to the impact of the new coronavirus, and growing debt repayments will hamper its recovery, the International Monetary Fund said. The Washington-based lender approved $4.3 billion in emergency financing for Africa’s most advanced economy on Monday. Read more: Reuters

Deutsche Bank on Wednesday reported a net loss attributable to shareholders of 77 million euros ($90.3 million) for the second quarter. This marks a stark improvement from the bank’s 3.2 billion euro loss for the same period last year. Read more: CNBC

Nissan’s shares have plunged by 10% in Tokyo trading after warning that it would see a record annual loss. Japan’s second largest carmaker said it expects a $4.5bn loss this year as the coronavirus hinders its turnaround efforts. The worse-than-expected forecast came as the company predicted its sales will be the lowest in a decade. Read more: BBC News

Kodak stock soared Tuesday morning after it won a a $765 million US government loan to help produce pharmaceutical ingredients — part of an effort to reduce dependence on foreign drug makers. Shares of Kodak, the onetime photography leader that now produces advanced material and chemicals, jumped 300% after it was reported. Read more: CNN

Capital Markets Report Sponsored By ZCCM-IH

In 1 trade recorded yesterday, 1,300 shares were transacted yielding a market turnover of K2,080. Trading activity was recorded in Lafarge. The LuSE All Share Index (LASI) maintained its close at 3,859.94 points, as there were no share price movements. The market closed on a capitalization of K55,621,451,258 including Shoprite Holdings and K21,382,245,278 excluding Shoprite Holdings.

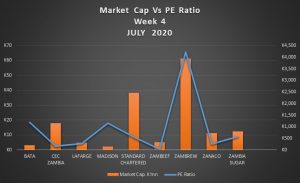

Chart of the Day: