Story of the Day:

Three weeks into June 2020 bond trading, the equities market regains its glory as it recorded a 40% to 60% on the bond market. Although it is not as great as we saw in final week of May but just as good for the month of June. Read more

Local Business and Finance Sponsored By Liquid Telecom

Ten of Zambia’s international bondholders have formed a creditor group ahead of what is expected to be a complex restructuring of its debts, they said on Tuesday. Read more: Reuters

Zambian government has terminated the Avoidance of Double Taxation Agreement with Mauritius and will initiate negotiations of a new Agreement which would introduce shared taxing rights and anti-abuse clauses. Read more: Zambia Reports

The second wave of coronavirus, which has hit China, will diminish efforts of restoring economies, which are already in depression, Economics Association of Zambia (EAZ) has said. Read more: Zambia Daily Mail

Government has called for more public private partnerships (PPPs) in identifying challenges and solutions to develop innovations that will add value to farmers’ productivity and boost the agriculture sector. Read more: Zambia Daily Mail

Auditor-General, Dick Sichembe has appealed to all heads of government departments to work with his office in order to reduce audit queries. Dr Sichembe says his office is creating strong stakeholder engagements on how to account for public resources through transparency and accountability. Read more: ZNBC

International Business and Finance

Japan has given the UK just six weeks to strike a post-Brexit deal, putting Boris Johnson’s government under pressure to agree one of the fastest trade negotiations in history — and Britain’s first in more than 40 years. Read more: The Independent

U.S. Treasury Secretary Steven Mnuchin said on Tuesday that a decoupling of the U.S. and Chinese economies will result if U.S. companies are not allowed to compete on a fair and level basis in China’s economy. Read more: Reuters

Apple shares rose nearly 2% Tuesday to about $364, bringing its year-to-date surge to about 25%. That also brings Apple’s market capitalization to nearly $1.6 trillion. It’s the most valuable company in America, and it’s also the second best performer in the Dow in 2020. Read more: CNN

South Africa’s unemployment rate hit a record high in the first quarter of this year as key sectors including agriculture shed jobs, data showed on Tuesday, highlighting weakness in the economy even before it was battered by the COVID-19 pandemic. Read more: Al Jazeera

A consortium of six global investors has entered into a $20.7 billion agreement with Abu Dhabi National Oil Company (ADNOC), the state-owned oil company said Tuesday. It is the single-largest energy infrastructure investment in the region, and the largest in the world in 2020. Read more: CNBC

Capital Markets Report Sponsored By ZCCM-IH

In 22 trades recorded yesterday, 2,971,511 shares were transacted yielding a market turnover of K386,296. Trading activity was recorded in CEC Africa on the quoted tier. The LuSE All Share Index (LASI) maintained its close of 3,944.98 points, as there were no share price movements. The market closed on a capitalization of K55,991,569,876 including Shoprite Holdings and K21,752,363,896 excluding Shoprite Holdings.

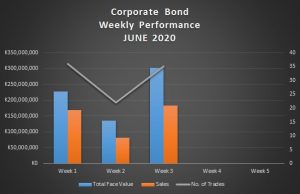

Chart of the Day: