In the tale of opposites, the final week of February corporate bond trading our pattern continues with the bond market eclipsing the equities market, with a score of 100% to 0%. Although, week two was a good week for the equities market in February as it was the first week in the year that the equities market was not completely dominated by the bond market as it recorded a score of 12%.

Equity Market Update

In the week ended 28th February 2020, a total of 33,955 shares were transacted in 23 trades, yielding a market turnover of K35,174. Trading activity was recorded in COPPERBELT ENERGY CORPORATION, LAFARGE, REAL ESTATE INVESTMENT ZAMBIA, STANDARD CHARTERED BANK LIMITED, ZANACO and ZAMBIA SUGAR. The LuSE All Share Index (LASI) closed at 4,250.48 points. The market closed on a capitalization of K57,319,774,180 including Shoprite Holdings and K23,080,568,200 excluding Shoprite Holdings.

In the final week of February 2020 trading on the LuSE. We see the performance of The LuSE All Share Index (LASI) in the past four weeks. In the first week LASI closed 4,251.54 points, in week two LASI closed with 4,254.23 here we see a point gain of 2.69 points. In week three LASI depicted a slight drop in points of 0.38 points as it closed with 4,253.85 points and in the final week LASI closed with 4,250.48 points again we see a drop in points from the third week of 3.37 points. Week two recorded the highest points for LASI.

Bond Market Update 28th February 2020

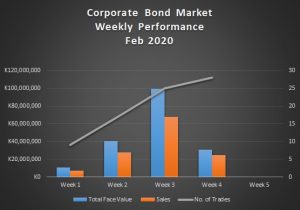

During the week, bonds of total face value of K30,830,000 were transacted in 28 trades, yielding a market value sales of K24,583,000. Week three of February corporate bond trading was the best performing for the month of February. We begin to see a pattern, as week three of January corporate bond trading as well was the best for the month of January.

Important announcements

SHOPRITE HOLDINGS LTD

Pieter Engelbrecht, chief executive officer:

We are very proud to report the Group’s 7.0% increase in merchandise sales for the six months to 29 December 2019.The R81.2 billion in sales was achieved on the back of 4.4% growth in volume of products sold and 2.1% growth in the number of customers. EBITDA, a more comparable measure after the adoption of IFRS 16: Leases, increased by 5.3%to R6.8 billion. This was a satisfactory performance given the 1.1% market share gains to 31.6% in Supermarkets RSA which achieved sales growth of 9.8%.