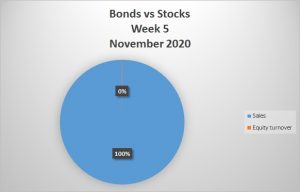

In a combined week of November and December 2020 trading on the LuSE, as Monday marked the end of November, the bond market completely dominated the equities market for that particular day as it ended the month as it recorded a 100% to 0%

In the first week of December we start the month on a good note as the equities market records a 35% to 65% on the bond market. Hoping this will end the final quarter of the year on a high note for the equities market.

At the 59th Annual General Meeting held virtually and at the Radisson Blu Hotel, Lusaka on 26th November 2020, a Final Dividend of 24 ngwee per share for the financial year ended 31st August 2020 was approved by the shareholders of Zambia Sugar Plc. Loss Per Share for the period ended 30 September 2020 is expected to be 166% higher than the corresponding period last year. The company recorded an increase in revenue due to improved performance in the period. However, the margins were eroded largely due to the increase in the prices of packaging materials that was driven by the depreciation of the Kwacha, thereby negatively impacting the operating results of the company. The margins also remained under significant pressure resulting from the continued unabated competition from the illegal trading in bulk beer.

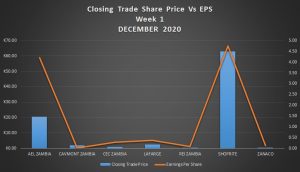

Equity Market

In the week ended 04th December 2020, a total of 12,416,414 shares were transacted in 85 trades, yielding a market turnover of K11,338,011. Trading activity was recorded in AEL ZAMBIA, CAVMONT CAPITAL HOLDINGS ZAMBIA, CEC ZAMBIA, LAFARGE, REAL ESTATE INVESTMENT ZAMBIA, SHOPRITE and ZANACO. The Index (LASI) closed at 3,847.99 points. The market closed on a capitalization of K57,227,324,429 including Shoprite Holdings and K22,988,118,449 excluding Shoprite Holdings.

Bond Market

Bonds of total face value of K49,751,000 were transacted in 13 trades, resulting in a market value sales of K30,709,000.

Important accouchements

CAVMONT CAPITAL HOLDINGS ZAMBIA PLC

The listing of all the Cavmont shares on the LUSE will be suspended and terminated with effect from 14:00 on 31 December 2020 (previously 18 December 2020 as set out in the Circular). This date is subject to amendment and any such amendment will be released on SENS.

In accordance with the requirements of the Securities Act No. 41 of 2016 and the Listing Requirements of the Lusaka Securities Exchange, NOTICE IS HEREBY GIVEN that the Final Dividend shall be payable to shareholders registered in the Company’s books as at close of business on Friday 18th December 2020. The payment date will be on or about 21st December 2020. Therefore, the last day to trade in order to be eligible to receive the dividend is Tuesday 15th December 2020.

NATIONAL BREWERIES PLC

In accordance with the Lusaka Securities Exchange (“LuSE”) Listings Requirements, the Board of Directors of National Breweries Plc (“Natbrew” or “the Company”) hereby advises the Shareholders of the Company that the Loss Per Share for the period ended 30 September 2020 is expected to be 166% higher than the corresponding period last year.

The company posted a 28% growth in revenue in a very difficult macro-economic environment disrupted by the Covid-19 pandemic. This growth was achieved on the back of a modest product price increase and improved volume performance compared to the previous year. Whilst the volume recovery is expected to hold during the remainder of the year, the pressures arising from the exchange rate depreciation will affect trading operating margins

A Member is entitled to appoint one or more proxies to attend, speak and vote in his or her stead. A proxy need not be a member of the Company. Proxies must be lodged at the registered office of the Company at least 48 hours before the time fixed for the meeting