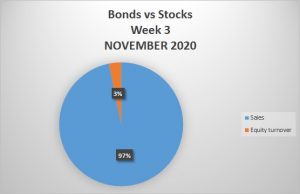

Three weeks into the month of November bond trading on the LuSE. We record a 4% decrease on the equities market from the week prior as it records a 3% to 97% on the bond market. The increase in losses, losses per share are a result of the substantial weakening of the kwacha, against the United States dollar (“USD”). An example is ZAMBIA METAL FABRICATORS PLC, 53% losses per share were recorded since the Group’s previous financial year-end and the corresponding re-measurement of the company’s USD based liabilities. The Group’s vulnerability to the volatility of the kwacha to the USD is a direct result of overdue VAT and duty draw back refunds due from the Zambia Revenue Authority (“ZRA”), which has required the Group to finance its own operations through the utilisation of dollar based funding. Which is the case for many of the securities on the market.

Equity Market

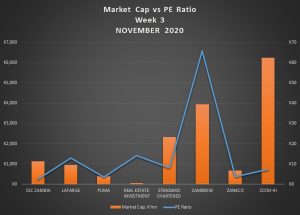

In the week ended 20th November 2020, a total of 5,671,053 shares were transacted in 84 trades, yielding a market turnover of K3,629,472. Trading activity was recorded in CEC ZAMBIA , LAFARGE, PUMA, REI ZAMBIA, STANDARD CHARTERED ZAMBIA, ZAMBIAN BREWERIES, ZANACO, ZAMBIA CONSOLIDATED COPPER MINES and CEC AFRICA on the quoted tier. The Index (LASI) closed at 3,898.56 points. The market closed on a capitalization of K57,447,993,287 including Shoprite Holdings and K23,208,787,307 excluding Shoprite Holdings.

Bond Market

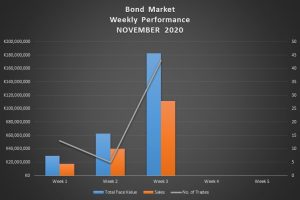

Bonds of total face value of K182,833,000 were transacted in 43 trades, resulting in a market value sales of K111,359,000.

Important accouchements

In accordance with the Lusaka Securities Exchange (“LuSE”) Listing Requirements, the Board of Directors of Zamefa (the “Board”) wishes to advise the Shareholders that for the financial year ended 30th September 2020, the basic loss per share (“LPS’) and head line loss per share (“HLPS”) are both expected to be between 217% to 237% higher than those of the prior year for both the Group and for the Company (collectively the “Group”).

For the financial year ended 30th September 2020, the loss per share (“LPS”) for the Group are 228% higher than the prior year and the for the Company the LPS is 227% higher the prior year.

CEC AFRICA INVESTMENTS LIMITED

CEC Africa Investments Limited (“CECA” or “the Company”) is a public company in terms of the Securities Act No 41 of 2016 (“the Act”) and its shares are registered and regulated by Securities and Exchange Commission of Zambia (“SEC” or “the Commission”). CECA shares are traded on the second-tier market (referred to as the Quoted Tier) of the Lusaka Securities Exchange (“LuSE”).