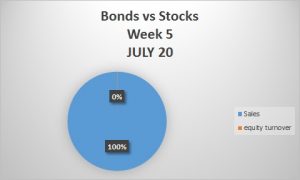

As we come to the close of July 2020 bond trading, once again the equities market’s glory was short lived. Our hopes of the final week of July having a massive turnaround for the equities market were in vain as the bond market completely dominated the equities market recording a score of a 100%. Thus week four of July was the best performing week for the equities market.

Equity Market Update

In the week ended 31st July 2020, a total of 21,218 shares were transacted in 36 trades, yielding a market turnover of K37,118. Trading activity was recorded in AIRTEL, BATA, CEC ZAMBIA, LAFARGE, MADISON FINANCIAL SERVICES, PUMA, SHOPRITE ZAMBIA and ZAMBIA CONSOLIDATED COPPER MINES. The Index (LASI) closed at 3,865.40 points. The market closed on a capitalization of K55,645,209,233 including Shoprite Holdings and K21,406,003,253 excluding Shoprite Holdings.

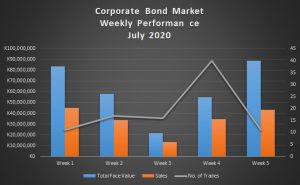

Bond Market Update

During the week, bonds of total face value of K88,749,000 were transacted in 11 trades, yielding a market value sales of K43,416,000.

Important announcements

INTRODUCTION Shareholders of Prima Reinsurance Plc (“Prima Re” or “the Company”) are referred to the Declaration Announcement published on Friday, 29 May 2020 and the Finalization Announcement published on Friday, 5 June 2020 as well the Circular to Shareholders dated Monday, 22 June 2020 setting out details of the Prima Re Renounceable Rights Offer of 15,000,000 ordinary shares (the “Rights Offer”) which was underwritten by the Industrial Development Corporation (“IDC”). The Rights Offer was structured on the basis of one (1) new ordinary share for every two (2) shares already held on the Record Date, Friday, 19 June 2020, at a subscription price of ZMW2.70 per new ordinary share.