Story of the Day:

In another magnificent turn of events the final week of June, just as recorded in the final week of May 2020 Corporate Bond Trading. The equities market recorded a great score for the second time this year. As it recorded another staggering score of 73% on the equities market to 27% on the bond market. Which is the highest we’ve seen this year. Read more

Local Business and Finance Sponsored By Liquid Telecom

Rating agency Moody’s has predicted that Zambia’s debt will go beyond 110% of its Gross Domestic Product this year. Read more: Lusaka Times

The Bankers Association of Zambia (BAZ) says increased liquidity levels in the market will help in lowering interest rates, which are currently averaging around 26 percent. Last Friday, liquidity in the market increased to K3,434.84 million from K2,850.71 million recorded previously on the back of the Bank of Zambia’s presence in the market through buying of government securities. Read more: Zambia Daily Mail

The price of copper soared to its highest level on Tuesday in more than five months due to strong demand prospects in top consumer China and worries about supplies from Chile, the world’s largest producer of the red metal. The benchmark copper on the London Metal Exchange touched its highest since January 21 at US$6,195 a tonne. Read more: Zambia Daily Mail

The Ministry of Energy says it is working on how best it can declare all electricity infrastructure in Zambia as common carrier after concerns were raised over the issuance of Statutory Instrument No. 57 which declared Copperbelt Energy Corporation (CEC) Plc infrastructure as such. Read more: News Diggers

Minister of Tourism Ronald Chitotela says a number of investors have shown willingness to construct modern infrastructure in tourist sites in the Northern circuit. Mr. Chitotela says this follows government’s initiative to provide incentives to investors that will come on board. He says local investors should not leave such an opportunity to foreigners, hence the need to come on board. Read more: ZNBC

International Business and Finance

South Africa’s manufacturing output fell 49.4% year on year in April during a nationwide lockdown, after contracting by a revised 5.5% in March, the statistics agency said on Thursday. Read more: Reuters

HSBC Holdings Plc, which draws more than two-thirds of its pretax income from Hong Kong, slumped as advisers to U.S. President Donald Trump discussed a potential move to punish banks in the city and destabilize the currency peg to the dollar. Read more: Bloomberg

Tesla will be able to make its vehicles completely autonomous by the end of this year, founder Elon Musk has said. Read more: BBC News

British mobile network operators have warned that removing Huawei equipment from their networks could lead to severe disruption for customers, with Vodafone going as far as to say it would cost the firm billions of pounds. Read more: CNBC

Capital Markets Report Sponsored By ZCCM-IH

In 13 trades recorded yesterday, 4,496 shares were transacted yielding a market turnover of K15,583. A share price loss of K0.03 was recorded in Copperbelt Energy Corporation. Trading activity was also recorded in AEL Zambia and Lafarge. The LuSE All Share Index (LASI) closed at 3,915.55 points, 0.29% down from its previous close of 3,926.75 points. The market closed on a capitalization of K55,863,479,239 including Shoprite Holdings and K21,624,273,259 excluding Shoprite Holdings.

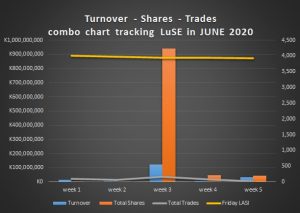

Chart of the Day: