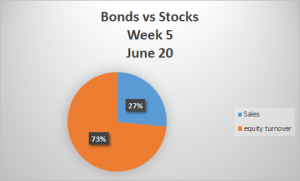

In another magnificent turn of events the final week of June, just as recorded in the final week of May 2020 Corporate Bond Trading. The equities market recorded a great score for the second time this year. As it recorded another staggering score of 73% on the equities market to 27% on the bond market. Which is the highest we’ve seen this year.

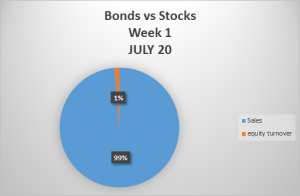

First week of July 2020 corporate Bond trading on the LuSE, the bond market completely eclipsed the equities market as it scored a 99% to 1% on the equities market.

Equity Market Update

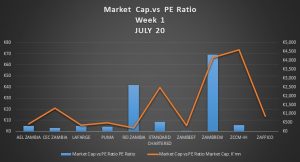

In the week ended 03rd July 2020, a total of 41,866,411 shares were transacted in 36 trades, yielding a market turnover of K33,080,865. Trading activity was recorded in AEL ZAMBIA, CEC ZAMBIA, LAFARGE, PUMA, REI ZAMBIA, STANDARD CHARTERED ZAMBIA, ZAMBEEF, ZAMBIA BREWERIES, ZAMBIA CONSOLIDATED COPPER MINES, ZAMBIA FORESTRY and FOREST CORPORATION and CEC AFRICA on the quoted tier. The Index (LASI) closed at 3,926.75 points. The market closed on a capitalization of K55,912,229,257 including Shoprite Holdings and K21,673,023,277 excluding Shoprite Holdings.

Bond Market Update

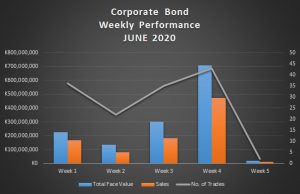

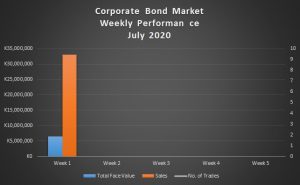

During the week, bonds of total face value of K83,722,000 were transacted in 11 trades, yielding a market value sales of K44,983,000.

The forth week of June was the best performing week on the Corporate Bond Market.

First week of July is Total Face Value, Trades and Sales.

Important announcements

Shareholders of Prima Reinsurance Plc (“Prima Re” or “the Company”) are referred to the 1st Announcement (Declaration Date) published on Friday, 29 May 2020 advising shareholders that the Company intends to raise ZMW 40.5 million, via a Renounceable Rights Offer (the “Rights Offer”) for Shareholders to subscribe for 15,000,000 (Fifteen Million) new Ordinary Shares.

In compliance with the requirements of the Securities Act No 41 of 2016 and the Listing Rules of Lusaka Securities Exchange, Pamodzi Hotels Plc, announces the audited financial results for the year ended March 31, 2020.