Story of the Day:

In week four of June 2020 trading on the LuSE, we revert back to our old pattern as the bond market completely dominates the equities market. As it records a score of 99% to 1% on the equities market. The equities market is glory was short lived as we saw last week it had a great score for the entire month of June. Read more

Local Business and Finance Sponsored By Liquid Telecom

Zambia, sold K5.2bln ($286mln equivalent) worth of pandemic bonds on Friday 26 June. Proceeds will be used to dismantle part of the outstanding arrears to retirees, suppliers and contractors. Read more: The Business Telegraph

Youth, Sport and Child Development Minister Emmanuel Mulenga says government aims to create over 10,000 jobs between now and December as a way of cushioning the impact of COVID-19 on young people. Read more: News Diggers

Zambia’s low liquidity levels in the economy have contributed to the declining annual rate of inflation in June, 2020, as the demand for goods on the market has reduced, says Zambia Institute of Policy Analysis and Research (ZIPAR). Read more: News Diggers

Zambia’ safari tourism sector is this year projecting to lose about US$100 million due to coronavirus with 168 safari lodges and camps closed, EcoTourism Association of Zambia chairperson Grant Cumings has said. Mr Cumings said about 7,000 jobs are on the brink of being lost. Read more: Zambia Daily Mail

The Zambia Association of Manufactures – ZAM has disclosed that the percentage of local products being stocked in the key chain stores in Zambia is currently sitting at only about 35%. Read more: Zambian Business Times

Trident Resources is acquiring a royalty from Moxico Resources over copper production from its operating Mimbula copper mine and associated stockpiles, located in Zambia’s Copperbelt Province. Read more: Mining Review

International Business and Finance

Government debt burdens across sub-Saharan Africa are rising at a faster pace and to higher levels than elsewhere in emerging markets, heightening the risk of further rating downgrades and defaults, ratings agency Fitch warned on Tuesday. Read more: Reuters

Asia’s economy is expected to shrink this year “for the first time in living memory,” the International Monetary Fund said, warning that the region could take several years to recover. The fund said Asia’s economy will likely contract by 1.6% this year — a downgrade from its previous forecast of no growth in April. Read more: CNBC

Airbus will cut about 15,000 jobs, or more than 10% of its workforce, over the next 12 months as it comes to terms with a plunge in demand for new aircraft due to the travel crisis caused by the pandemic. Read more: CNN

The UK economy shrank more than first thought between January and March, contracting 2.2% in the joint largest fall since 1979, official figures show. The Office for National Statistics (ONS) revised down its previous estimate of a 2% contraction, with all the main economic sectors dropping. Read more: BBC News

The U.K. government has signalled it is set to take a tougher line against Chinese telecoms equipment-maker Huawei. A review is under way into how forthcoming US sanctions would affect the UK’s continued use of its products. Read more: BBC News

Capital Markets Report Sponsored By ZCCM-IH

In 16 trades recorded yesterday, 41,697,981 shares were transacted yielding a market turnover of K32,950,960. A share price loss of K0.01 was recorded in Copperbelt Energy Corporation and a share price loss of K0.01 was recorded in Standard Chartered Zambia. Trading activity was also recorded in AEL Zambia. The LuSE All Share Index (LASI) closed at 3,919.57 points, 0.19% down from its previous close of 3,927.13 points. The market closed on a capitalization of K55,880,979,250 including Shoprite Holdings and K21,641,773,270 excluding Shoprite Holdings.

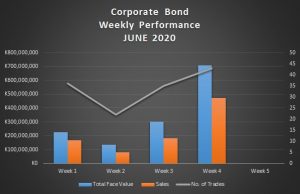

Chart of the Day: